Tax Farming(Farm with NFT)

Description#

- Nations receive taxes as tokens according to their power

- The power of nations is determined by many factors, including the DGDP, land NFT, and Civilization NFT.

- There are Regular Taxes paid every block time(14 seconds) and Special Taxes paid irregularly.

- Tax is distributed to the holders of Nation Ownership NFT.

Regular Tax#

- The current tax pool distributes 1,500 DENA per week.

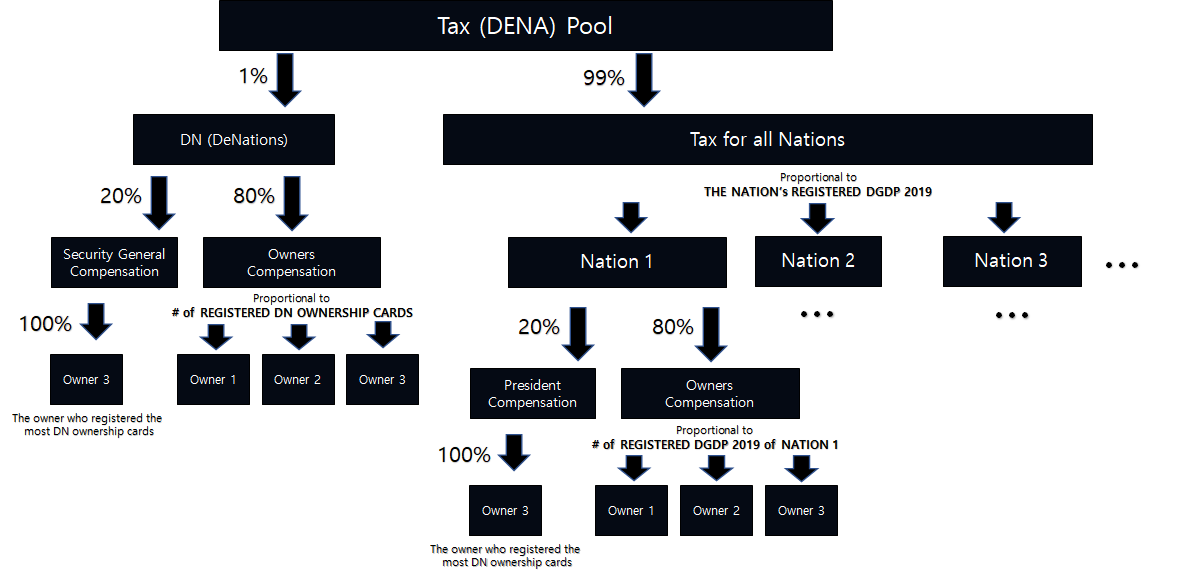

- 1 % of tax is distributed to the DeNations Ownership holders.

- 20% of tax allocated to DeNations Ownership is paid to the Secretary-General of the DeNations (who have registered the most # of DeNations Ownership NFTs)

- 80% of tax allocated to DeNations Ownership is paid to the owners of DeNations Ownership holders in proportional to their # of registered ownerships

- 99% of tax is distributed to the Nations in proportional to their total sum of registered DGDP

- 20% of tax allocated to a certain Nation is paid to the President of the Nations (who have registered the largest DGDP of the Nation )

- 80% of tax allocated to a certain Nation is paid to the owners of Nations Ownership holders in proportional to their registered DGDP.

Special Tax#

a) Founder Tax#

Definition & Source of Founder Tax#

10% of the nation ownership NFT sold per week is accumulated and distributed to players who registered at the beginning of the week.

Founder Tax Distribution#

Discontinuance of supply rounds. Therefore, the founder tax will be distributed based on a weekly basis. The Founder Tax will be distributed every Monday.

Register Nation Ownerships to Qualify#

You need to register your Nation Ownerships to qualify to receive Founder Tax.

Exceptions#

DeNations Ownerships & Myanmar Ownerships are excluded.

b) Civilization Tax#

20% of Civilization NFT revenue will be distributed to the Nation Ownership holder of the Civilization's belonging nation.

Business Tax#

Any business which uses DeNations' brand or operates inside DeNations must pay platform fees. 20% of the platform fee is defined as Business Tax and paid to the related Nation owners.

a) Business Art Tax#

20% of DeNations Art Fund generated from a certain art block of DeNations Art Chain, will be distributed to the Nation Ownership holder of the artist's belonging nation.